Become a CASH Buyer Now – With 79% of investor purchases reported as cash transactions in Q3 2021 (at average of 18.9% below market), give us a ring to learn how to use Hard Money Loans in Atlanta as a CASH Buyer now.

Real estate investor purchases accounted for 16.4% of all home purchases nationally in Q3 2021 compared with 11.7% in Q3 2020, a year-over-year increase of just over 40 percent, according to RealtyTrac.

The increase in investor purchase activity was national in scope as all but five states saw increases in the percentage of investor purchases among all home sales from Q3 2020 to Q3 2021. Alaska, Delaware, Iowa, Nebraska and Vermont were the only states to show a decrease in real estate investor purchases during that period.

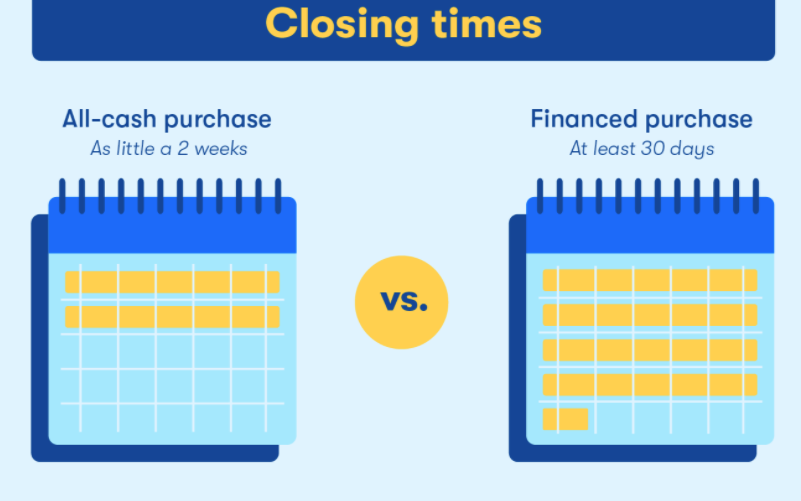

Investors continue to pay with cash in a majority of cases, with the share of all-cash purchases among investors increasing. In Q3 2021, 79.0% of all investor purchases were cash sales compared with 69.5% in Q3 2020, a year-over-year increase of 9.5 percentage points. Hard money loans have made all the difference for cash buyers.

Cash purchases accounted for more than 50% of all investor purchases in every state, other than Alaska, Wyoming and the District of Columbia.

Low Inventory Bring More Cash Offers

Residential buyers are also relying on cash offers , sometimes using a hard money loan to close a deal, especially in multiple offer situations, says Stacie Eagan Bender, agent, Sotheby’s International Realty, Rumson, NJ.

“With such limited inventory in Monmouth County, for example, buyers/agents are using everything in their toolbox to win homes,” Bender tells GlobeSt.com. “They are waiving financing, limiting home inspections to structural and environmental, waiving or limiting appraisals, and often offering sellers free or discounted rent backs.”

Cash offers are prevalent in any market experiencing limited inventory, she said.

[ Read the rest ]

Get A Quote For Funding For Your Real Estate Project: START BELOW:

Simple, Easy Process. No Hassle – No Obligation. We’ll Call You Within 48 Hours.