Worried About Market Correlation? How Private Debt Can Diversify Your Retirement Portfolio.

One of the biggest anxieties for retirees is watching their entire portfolio swing in unison with volatile public markets. Traditional diversification across stocks and bonds might not be enough when broad market downturns hit. This is where alternative investments, like private debt, can play a valuable role.

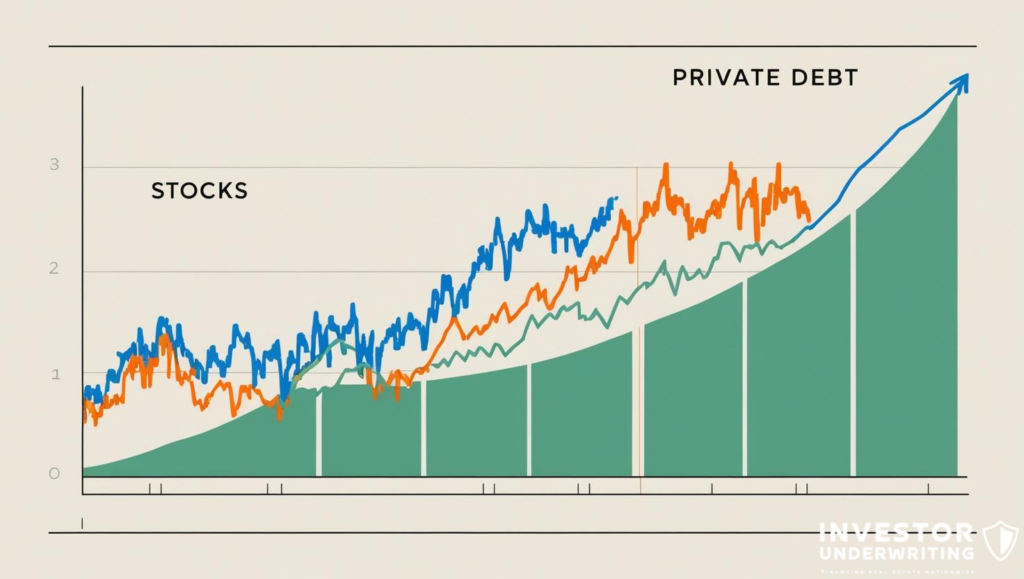

A key potential benefit of private debt is its historically lower correlation to public equity and fixed-income markets. Because private debt deals are negotiated and operate outside the daily fluctuations of Wall Street, their performance drivers are often different.

Asset-Based Lending (ABL), for example, relies on the cash flow from specific underlying collateral, which may be less directly impacted by overall market sentiment or geopolitical events compared to stock prices. For Baby Boomers seeking to build a more resilient retirement portfolio, adding an allocation to private debt could potentially reduce overall volatility and smooth out returns over the long term.

Investor Underwriting’s focus on ABL offers exposure to this asset class, aiming to provide income streams driven by factors less tied to public market performance. This approach seeks to enhance portfolio stability, a critical goal for those relying on their investments for retirement income. Learn more about how alternative assets can diversify portfolios and potentially reduce risk.

Call to Action: Interested in exploring diversification through private debt? Connect with Investor Underwriting to discuss your portfolio goals.